IndependentContractors

HWS Independent Contractor Policy

This information has been prepared to inform you about the policy and procedure regarding payment to an individual for services. This information will assist you in making a determination as to whether an individual is an independent contractor or an employee, and whether the payment to that person should be made through Payroll (HWS employee) or Accounts Payable (independent contractor). If you have questions about this information you can contact the Payroll Department or the Human Resources Department.

Definitions

Independent Contractor/Consultant

An independent contractor is an individual or non-corporate business entity who follows an independent trade and offers his/her services to the public. The general rule is that an individual is an independent contractor if (among other items) HWS has a right to control or direct only the result of the work, not the means and methods of accomplishing the result.

- Payments made to independent contractors are processed through Accounts Payable. Entities receiving $600 or more in gross income during a calendar year will receive a Form 1099-MISC to report the income on their tax returns. They are responsible for remitting their own (federal, self-employment, and/or state) income tax payments.

Employee

An employee is an individual whoperforms services that are subject to the will and control of HWS both what must be done and how it must be done. HWS may allow employee discretion and freedom of action but HWS maintains the legal right to control both the method and the result of the services.

- Payments to employees are processed through Payroll and applicable taxes are withheld at the time the payment is made. HWS remits the payments to federal and state governments.

Policy

Employees Acting as Independent Contractors/Consultants

This policy regarding current employees acting as independent contractors takes into consideration federal regulations and tax law. This policy states that all services performed by an HWS employee acting as an independent contractor will be considered "additional pay" and will be processed through Payroll.

- The only exception to this policy is for an employee who has an established corporation through which he/she conducts his/her business as an independent contractor.

- The employee will be required to complete a Form W-9 (Request for taxpayer Identification Number & Certification) and HWS will maintain the form on file for audit purposes.

Ex-Employees and Retirees Acting as Independent Contractors

Frequently, retirees and ex-employees are engaged to perform services for HWS.

- If a retiree or ex-employee is rehired in the same calendar year that he/she terminated his/her employment from HWS, the individual should be hired through the Human Resources Office and paid through Payroll.

- If the retiree or ex-employee is engaged to perform services the year after (or beyond) the year that his/her employment was terminated from HWS, a determination will be made how the payment should be processed.

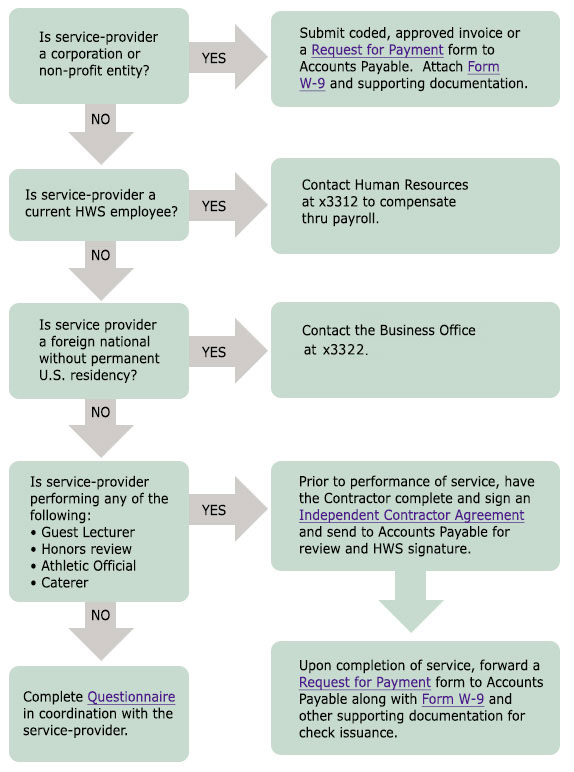

To Process a Payment to an Employee or Independent Contractor please follow the flow chart for further direction.